Regulations for Medicare Mandatory Reporting Penalty are in the process of being formalized!

Under the threat of up to a $1,000 per-day, per-claim penalty, most insurers and self-insurers have implemented processes to ensure Medicare beneficiary claimants are reported to Medicare per Section 111 of the Medicare, Medicaid, and SCHIP Extension Act of 2007 (MMSEA).

Penalties have never been imposed as the SMART Act specified that the Centers for Medicare and Medicaid Services (CMS) must formalize regulations prior to issuing them. This past February, CMS released proposed regulations, which we detailed in this article: CMS Issues Proposed Rule for Mandatory Insurer Reporting Penalties. Comments on the proposal were due in April and now we await a final regulation.

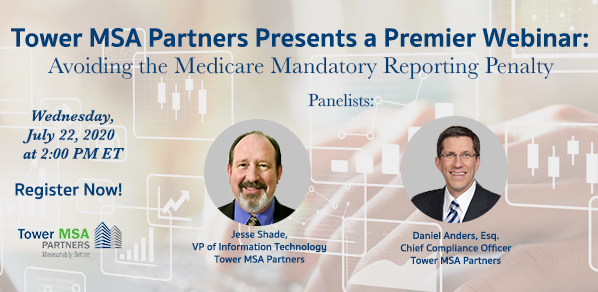

In a timely webinar, a full analysis of CMS’s penalties proposal will be provided by Tower’s Chief Compliance Officer, Daniel Anders, Esq. Joining Dan will be Jesse Shade, Tower’s VP of Information Technology, who will break down new user-friendly enhancements to Tower’s Mandatory Insurer Reporting platform that are designed specifically to avoid the penalties CMS seeks to impose.

A Q&A session will follow the presentation. Plan to attend the webinar on Wednesday, July 22, at 2 pm ET.

Thank you,

Dan Anders

Chief Compliance Officer